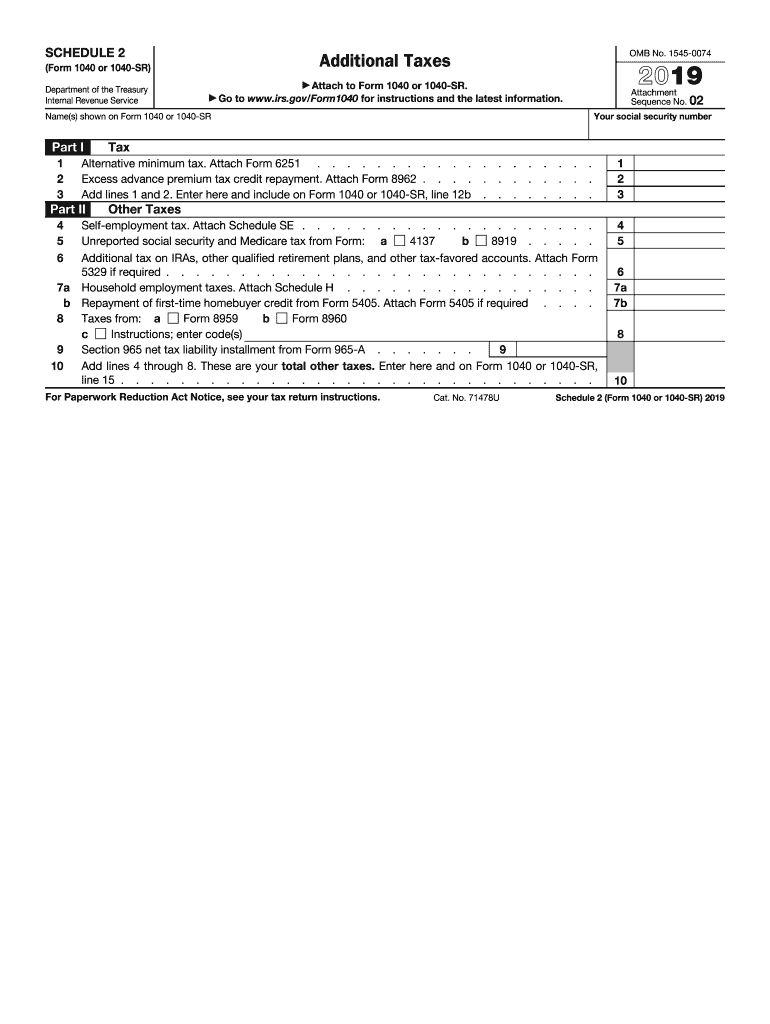

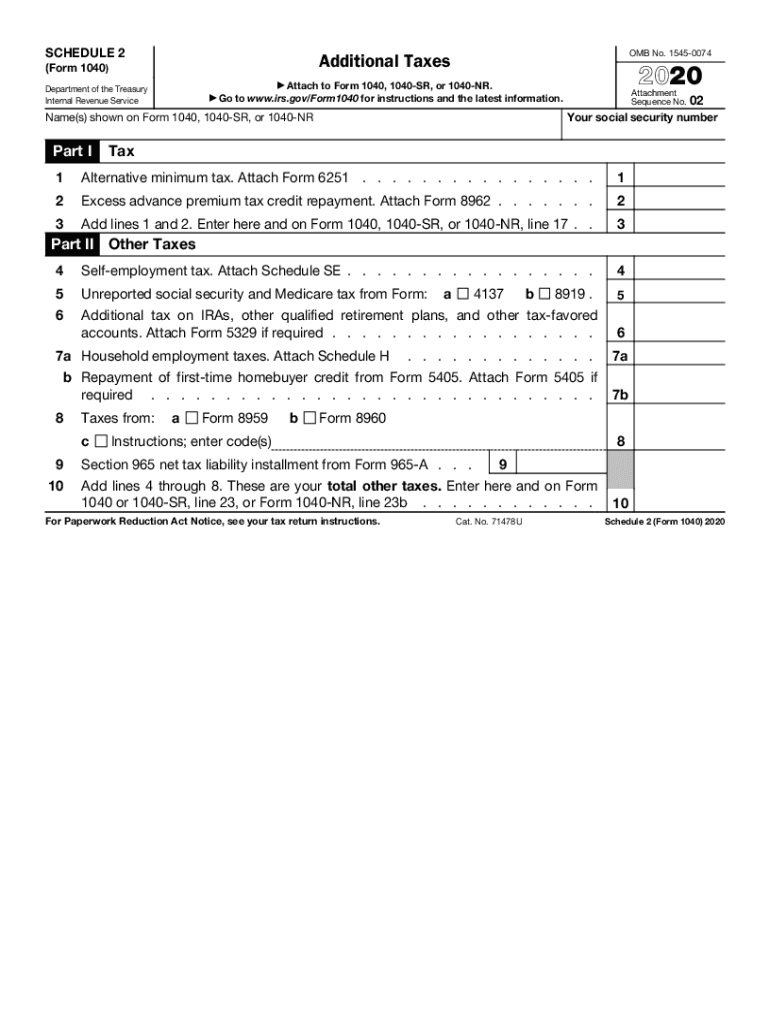

2024 Form 1040 Schedule 2 Form 1040 – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . This includes items such as: You can also use other IRS schedules (additional forms) with Form 1040-SR, such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR. .

2024 Form 1040 Schedule 2 Form 1040

Source : studentaid.gov1040SCHED2 Form 1040 Schedule 2 Additional Taxes (Page 1 & 2

Source : www.nelcosolutions.comWhat is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule 2: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule 2 line 2 fafsa: Fill out & sign online | DocHub

Source : www.dochub.comWhere To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Source : studentaid.govSchedule 2: Fill out & sign online | DocHub

Source : www.dochub.comForm 1040 Schedule 2 Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.com2024 Form 1040 Schedule 2 Form 1040 Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid: As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). . Before you fill out a Form 1040, make sure you have your W-2 form, which contains your earnings Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that .

]]>.png)

.png)