2024 Form 1040 Schedule Caste – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

2024 Form 1040 Schedule Caste

Source : www.signnow.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

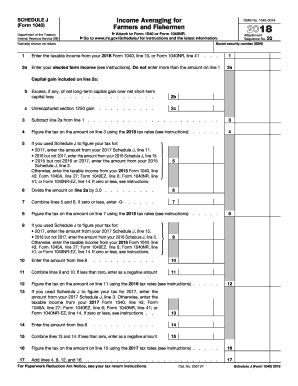

Source : turbotax.intuit.com1040 Schedule J 2018 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.comIRS Call Centre Scam: Mastermind Sagar Thakkar’s aide arrested in

Source : m.economictimes.comAlexander Accounting & Tax Service Group, Inc. | Knightdale NC

Source : www.facebook.comJoin us in 2024 for the Book & Film Discussions Southern

Source : sdarj.orgAmericans’ 90% tax rate | CNN

Source : www.cnn.comUCCS Department of Visual and Performing Arts | Colorado Springs CO

Source : www.facebook.comForests | January 2024 Browse Articles

Source : www.mdpi.comIndian American Vivek Ramaswamy quits Presidential race, throws

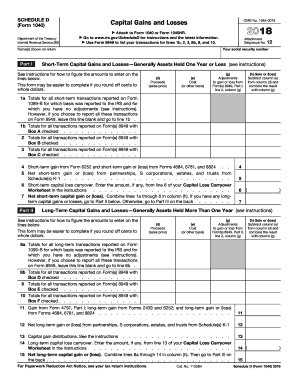

Source : www.iglobalnews.com2024 Form 1040 Schedule Caste Irs S 1040 Schedule D 2018 2024 Form Fill Out and Sign Printable : Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>